THE LATEST

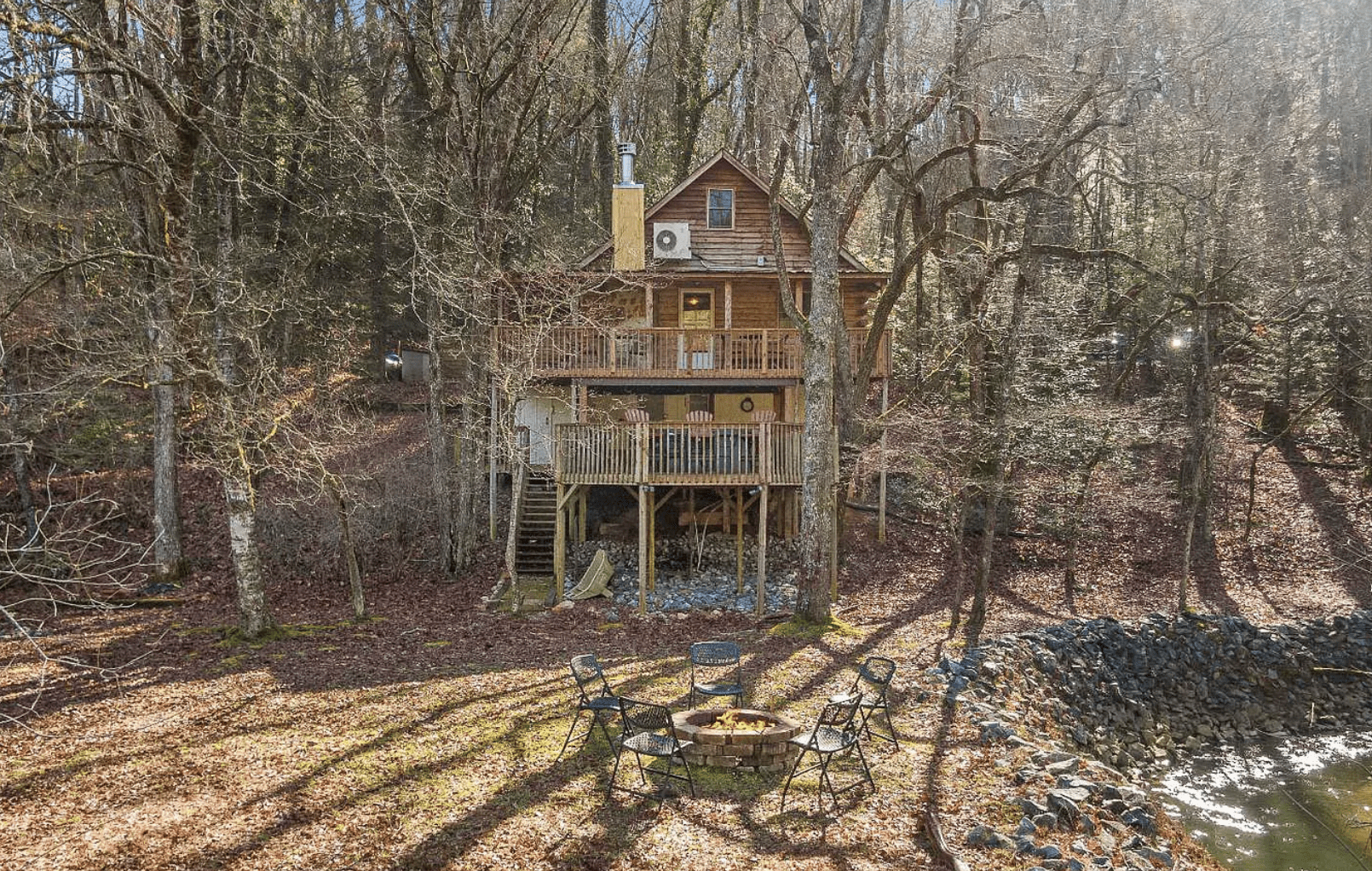

Would You Buy This Property?

Check out this property on Zillow

Ask yourself the following:

- For $350k, what would you need to make in revenue to break even?

- How about to make $25k a year in passive income after all expenses?

- What about $50k, or 75k?

- What are the 3 first things you'd change or upgrade to make the space better?

- What micro-market would you go after within this market?

I'm not as concerned about if you know these answers yet - most don't, and that's why they can't invest profitably, early, and often.

What I am curious about is:

- Can you see yourself making these decisions?

- Can you see yourself enjoying the process?

- If you really mastered it over a period of 6-8 weeks, got through the whole process, and got your first property producing, do you think you could do it again 3 or 4 more times?

- If you did, would you quit your job? Scale back your hours? Book some family trips you've been putting off?

As I talked about last week, the #1 reason most people aren't where they want to be financially is they do not have a strong and clear enough "Why".

It all starts with Why.

Less than 10% of the population thinks LONG-TERM (3-5 years+ out).

I would submit to you that the decisions you make about what asset classes to invest in in the next 18 months will be some of the most important decisions you ever make.

If you haven't given Lifestyle Assets a good thorough look, we'd love to show you the ropes so you can get a good idea if this is a lane you'd like to run down.

What’s the process for buying a lifestyle asset?

When it comes to making financial decisions for the long-term, investing in lifestyle assets is a great option. Lifestyle assets are investments that not only provide you with financial gains, but also make a positive impact on your quality of life. Investing in lifestyle assets can help you achieve your financial goals.

The first step in investing in lifestyle assets is to understand what type of assets you want to invest in. If you're looking to purchase a short-term rental home, for example, you'll need to research the local market to determine the type of property that best meets your needs. You'll also need to consider how much you can comfortably afford and make sure you have the necessary funds saved to make the purchase.

Once you've decided what type of lifestyle asset you want to invest in, it's important to do your due diligence. This means doing research on the asset, such as the current market value, any major repairs or renovations that may need to be done, and the potential for appreciation. It's also important to consider the associated costs of owning the asset, such as property taxes, insurance, and maintenance.

Finally, it's important to consider the tax implications of investing in lifestyle assets. Depending on the type of asset you're investing in, you may be eligible for certain tax breaks or deductions. It's important to research the tax implications of investing in lifestyle assets and consult with a qualified tax professional to understand the full impact of the investment.

Investing in lifestyle assets can be a great way to reach your long-term financial goals. By taking the time to do your research and understand the associated costs and benefits, you can make informed decisions that will have a positive impact on your financial future. If you're ready to start investing in lifestyle assets, book a call with us today and we'll help you understand the process and make decisions that will help you reach your long-term goals.

Most Recent

Social

920 S Chambers Street #11, South Ogden, UT 84403

DISCLAIMER: The contents of this site are for educational and informational purposes only, and are not to be construed as legal, tax, or financial advice. Any financial results referenced herein should not be considered typical; success depends on a multitude of factors. Use caution and always consult licensed professionals for any tax, legal, or investment advice. All results achieved by our members are their results alone, achieved by their own individual effort and made easier by our help. Investing in education, training, and coaching is an excellent investment for individuals who are willing to implement it and persist until they achieve the results they desire; it is not intended as a substitute for individual effort, decision-making, and due diligence.