How to Invest in Vacation Homes: A Step-by-Step Guide to Building Lifestyle and Financial Freedom

Unlocking the Potential of Vacation Home Investing

Investing in vacation homes is much more than acquiring a second property; it’s about intentionally building a path toward lifestyle flexibility and long-term financial security. Whether you’re motivated by the thought of creating lasting memories for your family or generating a new stream of passive income, understanding how to invest in vacation homes is the first step toward transforming your goals into reality. In this educational guide, we’ll break down the key steps, insider insights, and practical considerations that set top-performing investors apart in this thriving asset class.

Understanding the Vacation Home Investment Opportunity

The surge in demand for short-term rentals and vacation homes has opened new doors for everyday investors. Yet, the difference between a property that simply covers its costs and one that delivers true lifestyle and financial freedom lies in how you approach the process. Successful vacation home investors don’t just buy real estate—they acquire what we call ‘Lifestyle Assets’: properties that serve both personal enjoyment and robust income potential.

Step 1: Clarify Your Goals and Buyer Type

Start by pinpointing what you want from your investment. Are you seeking maximum cash flow, a place for family getaways, or a blend of both? Understanding your primary motivation helps you define your buyer type, which will shape your property search, market selection, and management approach. Be realistic about your timeframe and resources, and identify any gaps in your knowledge so you can address them up front.

Step 2: Determine Your Buying Power

Before diving into listings, calculate your total budget and reserves. Consider these three main components:

- Down Payment: Typically 10% for vacation/second home loans and 20-25% for investment-specific loans.

- Setup and Furnishing Costs: Budget an additional 8-10% of your purchase price for furnishing and improvements, even if the property is labeled turnkey.

- Initial Operating Reserves: Set aside 6-9 months of property expenses as a cushion while establishing consistent rental income. This helps alleviate the financial roller coaster during your initial setup phase.

Step 3: Identify Profitable Markets

There is no universal answer to “where should I buy?”—the right location depends on your goals, interests, and the property’s income potential. Start with destinations you genuinely enjoy. Then drill into data points like:

- Historical occupancy rates and seasonality

- Average nightly rates (ANR) and projected revenues

- Local short-term rental regulations

- Neighborhood desirability and guest amenities

Look for ‘pockets of opportunity’—areas within larger markets where your specific goals align well with demand and acquisition price. A thoughtful, data-driven approach beats following hype every time.

Step 4: Build Your Dream Team

Surround yourself with experienced professionals. Your success will be directly related to the strength of your partners, including:

- Local real estate agents familiar with vacation rental markets

- Lenders who understand vacation home financing

- Property managers, tax specialists, and insurance advisors

- Interior designers and legal counsel for asset protection

Getting advice from specialized experts ensures a smooth process from acquisition through guest hosting.

Step 5: Analyze and Acquire the Right Property

Property analysis is the backbone of smart investing. Evaluate each opportunity with a clear eye toward:

- Cash flow projections based on conservative estimates

- Guest experience potential (think multiple master suites, quality amenities, and ideal bedroom-to-bathroom ratios)

- Compliance with zoning, licensing, and HOA rules—do your own homework and always review regulations in writing

Make offers only when your numbers, research, and team all point to a viable deal.

Step 6: Set Up for Guest Excellence

Transforming your purchase into a top-performing vacation rental means going beyond the basics. Invest in high-quality furnishings, thoughtful design, and ensure every detail caters to guest comfort. The guest experience is the single biggest driver of premium rates and 5-star reviews, which fuel your property’s long-term profitability.

Step 7: Launch, Market, and Optimize

Leverage professional marketing, high-end photography, and detailed listings to stand out on booking platforms. Over time, develop your own repeat guest base and continue optimizing your operation for higher occupancy and revenue. The best investors treat this as an ongoing business, not a set-it-and-forget-it proposition.

Common Mistakes to Avoid

- Investing without thorough due diligence or relying solely on emotion

- Skimping on guest experience or property management

- Waiting for the ‘perfect’ market timing—focus on deals that make sense today

- Getting sidetracked by properties or locations that don’t actually fit your long-term goals

- Quitting early—success builds over time through consistent execution

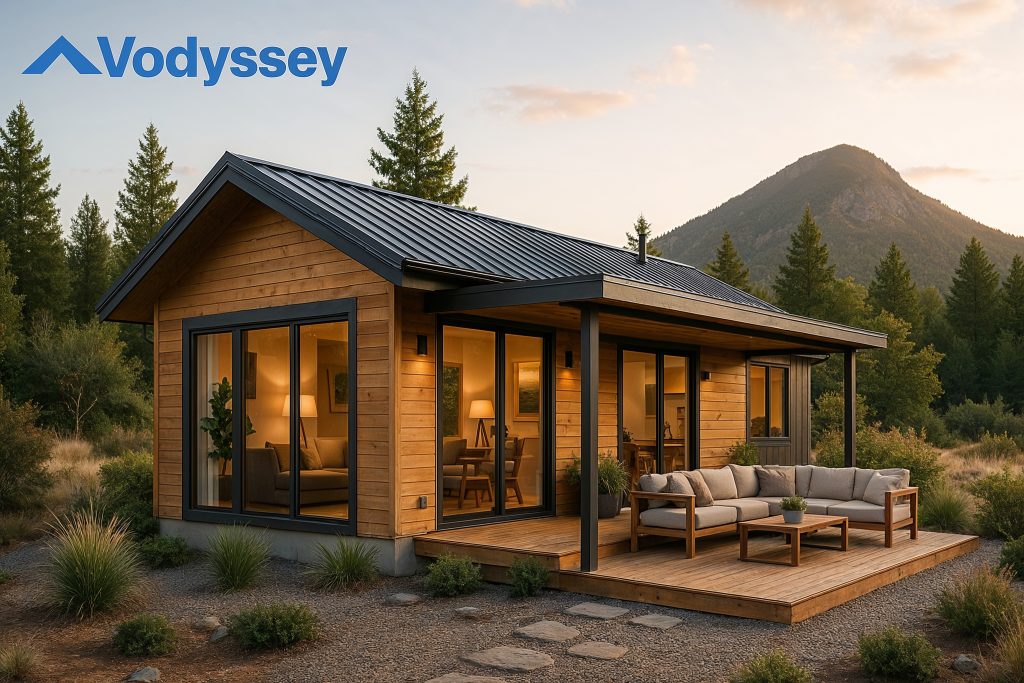

The Vodyssey Advantage: Proven Support on Your Journey

Every investor’s journey is unique, but you don’t have to go it alone. At Vodyssey, we’ve helped thousands of members master every stage of the vacation home investing process, from first purchase to portfolio expansion. Our step-by-step system, robust community, and hands-on coaching give you the unfair advantages you need to succeed without years of trial and error. If you’re ready to see what’s possible with lifestyle asset investing, take the next step.

Ready to Start Your Vacation Home Investment Journey?

Schedule a free call with our team to discuss your goals, get your questions answered, and explore how you can accelerate your progress with expert guidance. Book your call now and begin your journey toward lifestyle and financial freedom through vacation home investing.